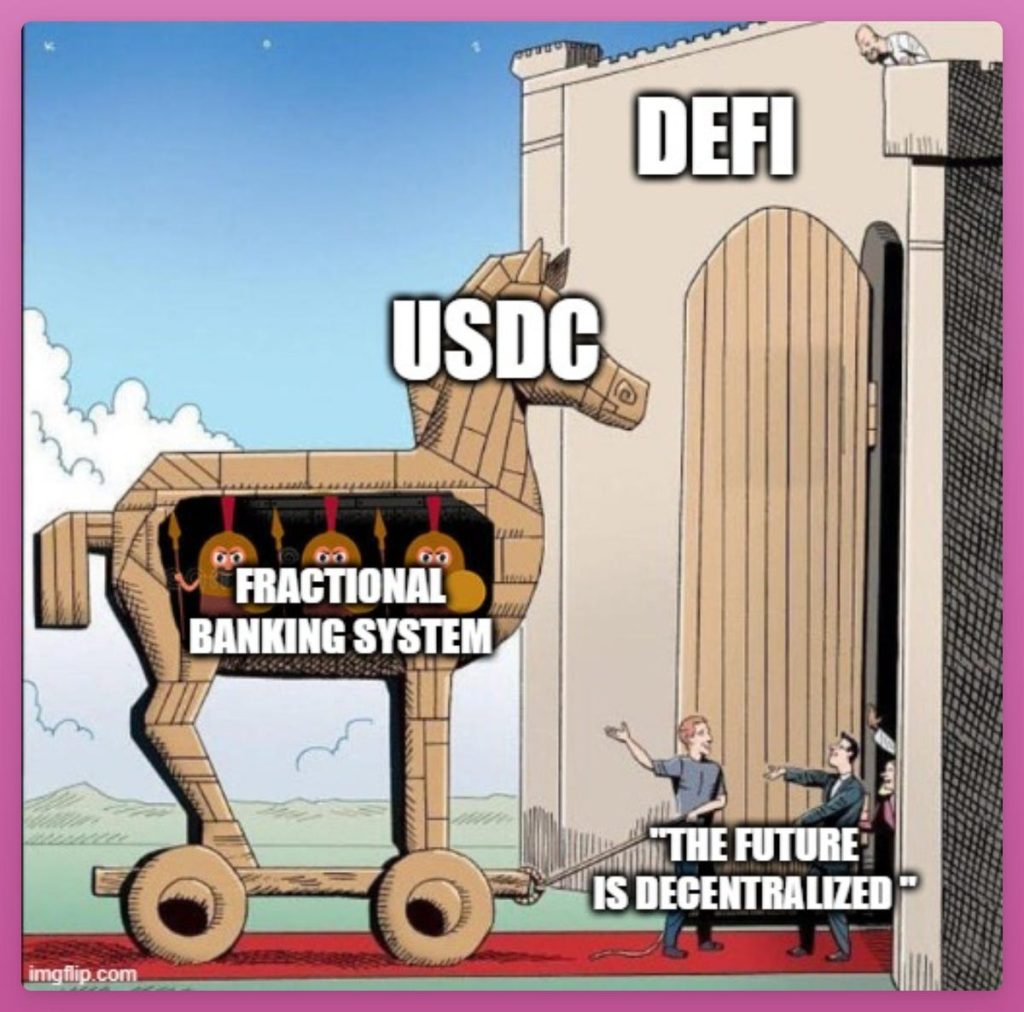

How decentralized DeFi really is? The USDC depeg has raised significant concerns and questions about it.

- USDC and DAI stablecoins lost 1$ peg

- Euler Finance exploited

- InstaDapp introduced Avocado

1. USDC and DAI stablecoins lost 1$ peg

tl;dr: If DeFi shouldn’t be just a rebuilding of an tradinational financial system, USDC event must be a big wake up call.

USDC issuer Circle had $3.3B of its $40B reserves stuck at bankrupted Silicon Valley Bank (SVB), leading to a significant depeg of its stablecoin to as low as $0.80. Also the DAI stablecoin saw a depeg to $0.89.

Both stablecoins regained their $1 peg after the US government and financial regulators insured all uninsured depositors at SVB.

- no DeFi protocols “broke” as a result of the de-peg

- DeFi must reduce its dependence on fiat-backed stablecoins that are beholden to the fragility of TradFi

- decentralized assets {BTC, ETH or ETH-backed stablecoins LUSD, RAI) as a ‘safe-haven’ during times of crisis

2. Euler Finance exploited

Lending protocol Euler Finance suffered a massive hack, when $197M of USDC, wBTC, stETH and DAI were stolen in a flash loan attack.

The vulnerability had existed for eight months before the exploit. Despite Euler demanded a hacker to return stolen funds back, he moved 1000 ETH in ten different transactions to Tornado Cash to anonymize these funds.

But later on he started to return them back.

What are the key takeaways?

Before using DeFi, be sure to get know DeFi risks, how to stay safe or insure your-self.

3. Instadapp introduced Avocado

Instadapp is a multi-protocol dashboard to make DeFi more accessible and user-friendly. It aims to simplify the process of interacting with dapps.

They introduced Avocado, that is a smart contract wallet, which enables you to perform multi-network transactions, while you’re connected to a single network, Avocado.

What does it mean?

- you can directly interact with any dapp on any supported L2 or sidechain from your wallet, ie. no ‘switch network’ or ‘bridge funds’

- pay gas in USDC

- non-custodial, ie. no one can touch your funds

- same level of security

- smart contract wallet use cases, such as batching transactions, unified cross-chain executions, recovering your wallet, adding different roles, a gasless experience, and more

Learn more: 1

Please let us know how you enjoy reading, what you liked or what you missed, by leaving a comment below.

Not financial or tax advice. This post is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions This post is not tax advice. Talk to your accountant. Do your own research.